OUR BEST SELLING COURSE AND MEMBERSHIP

DOUBLE YOUR OPTION OR STOCK TRADING ACCOUNT IN

RECORD TIME! OR YOUR MONEY BACK*

Inside the Platinum Traders Beta Testers Group 2.0, you get the privilege and right to watch how I trade in real-time. You get real time text alerts sent directly to your smartphone, you get weekly group coaching calls, monthly mastermind sessions, and you get to follow along with my options trading and stock trading journey to make sure you acquire all the skills needed to become a highly effective and profitable option and stock trader inside our secure membership site.

David Schloss - Turn On Sound To Hear Video

95% Of Option Traders And Stock Traders Are Failing, (Yes the stat is that high) Losing Money Hand Over Fist, But Here Is How You Can Be Among The Other Top 5% Of Option Traders And Stock Traders Who Make It So That You Can Gain New Effective Skills, Be Highly Profitable, And Grow For Life.

We Call It Educate and Profit...(Allow me to explain.)

You see, our professional trading setup systems can teach all experience levels various styles of options trading and stock trading, including scalps, intra-day trades, day trades, and swing trades.

With our real-time text alerts sent right to your smartphone, we also keep the group aware of different trade opportunities while notifying when to consider taking profits!

We enable you to invest in the stock market by providing education and live coaching, real-time text alert trade call-outs, and an entire community with members of all skill levels.

-

"Allow Me To Show You How To Take The Skills You'll Learn Inside My Secure Membership Area And How To Apply Them to This Market Volatility Now."

-

Discover How To "Hunt" For The Stocks That Really Pop For Maximum Gains.*

Do you know how many traders have lost their shirts, pants, houses, cars, and worst their dignity in this market?

Tons.

Many traders and investors have been battered by this volatility mess… and that’s not okay because this market is a different beast and was completely unexpected, it caught everyone by surprise.

However, that doesn’t mean you try to do the same thing over and over again, like everyone else, especially if it’s not working.

-

Open Interest VS Volume Which Do You Follow?

You want to know why many traders make this classic mistake which cost them and you a fortune.

Volume and open interest are two key indicators that options and futures traders can use to gauge the activity of contracts in their respective markets and many still get this wrong and end up on the wrong side of the fence looking at empty pockets and blown trading accounts.

A change in open interest and volume is an important activity that is looked at closely by traders, but there is a massive difference between the open interest and volume and you need to know why each indictor is completely different.

-

The Dow notched its worst first quarter in history in 2020… and the S&P 500 had its worst quarterly performance since the financial crisis. (This may change over time but for the moment its bad and you need to know how to navigate the waters)

Could we see wild price action again?

Who knows, but you'll learn how to avoid the pitfalls and end up on the other side so please scroll down the page and join today so I can walk you through everything.

-

In this market environment, I've recommitted and refocused myself to learning this options game and my attention is to be a hunter instead of the hunted and I've found a way to find and hunt down "Launch Pad" type stocks to trade options with.

Why use this strategy?

Well, that's simply because my method has proven to work even during violent selloffs *(Things could change that's why I'm constantly testing to see new ways to help my members try to get ahead in the markets)… and I want to show you exactly how to "hunt" these stocks down that really pop so you can get over the frustration of having to waste hours when in minutes your work is done and you're in the markets.

-

Why Many Traders Screw Up Bid VS Ask And Lose Thousands!

So here's the deal, if anyone tells you that trading options is easy or more easy thank trading stocks is lying to you.

You better turn around and run.

That said,

Almost everything about options trading is different from trading stocks.

Even the bid vs. ask spread can be confusing if you don’t know what you are searching for and I'm here to help you work through each one because if you get this wrong it will cost you so I'm here to help you get through it.

Start to fill out the checkout cart form now so you can be inside the members area fast and you can learn how to play the game of options and learn how to win..

SPECIAL OFFER

100% Of The Bonuses disappears in...

Take Advantage of this incredible offer today and you'll receive all the bonuses including a one on one live zoom call with Double P to help you short cut your next trade to at least +30% profit. Take this offer now before the live zoom call disappears forever and the course goes back up to its regular price.

You're about to get access to a little-known trading system that makes option trading and stock trading easier using my top 3 options trading and stock trading strategies and (by following the smart money.)

One of the biggest mistakes that option traders and stock traders make is to give too much attention to losses.

STOP worrying about trading losses...

Because trading a small account can be tough, especially during wild market volatility, you need to keep your emotions in check, keep a level head, and understand what's going on in the marketplace.

But when you can keep your emotions in check and know how to trade efficiently and profitably (I'll show you), it can also be rewarding.

The truth is...

Most traders are unprofitable because their focus is to avoid losses.

You get what you focus on.

You want to know why most traders focus on their losses and use some of the most weakest strategies?

Well, it's because the trading game has changed following a global pandemic, stock market crash, and economic uncertainty worldwide.

Most traders are thinking about taking trades the old-fashioned way.

Traders today must drill down with highly focused strategies to find which setups are working today — especially in a highly volatile market.

Using our strategies, we generate actionable and profitable trade ideas in real time and send them to an amazing group of new, and seasoned international traders and guide our members with educational coaching for preparation in the stock market, risk management and technical analysis.

Our focus is on maximizing the winners.

When you make more on the winners, the losses simply become a business expense.

Think about it - if your business has massive profits, paying the electric bill is no big deal, right?

Isn't it a fact, some trades are simply better than others? Finding those trades, and MAXIMISING THE PROFITS in them, makes trading a lot easier.

That's what makes us different.

We focus on trades with existing demand, the right amount of volatility, and watch what the "smart money" is most attracted to, and we have systems in place for maximizing the winners.

If you're ready for something new, climb onboard our quant-style driven systems that we break down for you with simple step by step, easily digestible lessons and rule-based action steps, so you can see results quickly.

I'd like to coach you for the next 30 days, then if you like it, another 60 days, AND give you my exact entries and exits sent directly to your smartphone... for all three of my trading styles; intra-day momentum trading, profitable day trades and swing trades.

What separates this information is that it’s based on real world strategies, systems, is rules based without emotions and driven by success with real people, real option traders and real stock traders.

Real people, real money, real traders. Traders are just like you.

Are you ready to be a profitable trader?

Great!

Because you asked for it, you got it.

I want you to "Look over my shoulder" and watch how I enter the markets to generate income so that you can build your confidence and change your current lifestyle. *(Please see our disclaimers/disclosures below.)

WARNING!...

Let's first address the elephant in the room and get that out of the way.

So this is my personal journey, as I trade options and stock trading and nothing is guaranteed.

I highly recommend when you buy my course you trade in a paper money account and/or a virtual simulator at first before you spend a penny in any real market trade, so that you understand the fundamentals first.

Also, so that you know my systems and strategies work without emotion.

Yes, there is emotion in trading, but I'm going to show you how to turn the emotion you see in the marketplace into your advantage.

My trading style is profitable and consistent.

First, I am an intraday momentum options and stock scalper, which is my bread and butter.

Which means I'm in and out of positions within a few minutes, up to an hour or two, while the algos do their thing.

I follow the price action, volume, order flow and stay in the trend until I hit my profit parameters, then I'm out.

This allows you to not have to sit by your computer screen for hours or all day, sweating over what's going to happen in your positions.

Second, I'm a day and swing-style option trader and stock trader.

Sure, I can hold a stock position or option position overnight just as easily and be profitable, or hold a position for a multi-day runner and momentum trend trade, then exit with a healthy return as well, and I can teach you that too.

OK, here's the part that's going to blow you away.

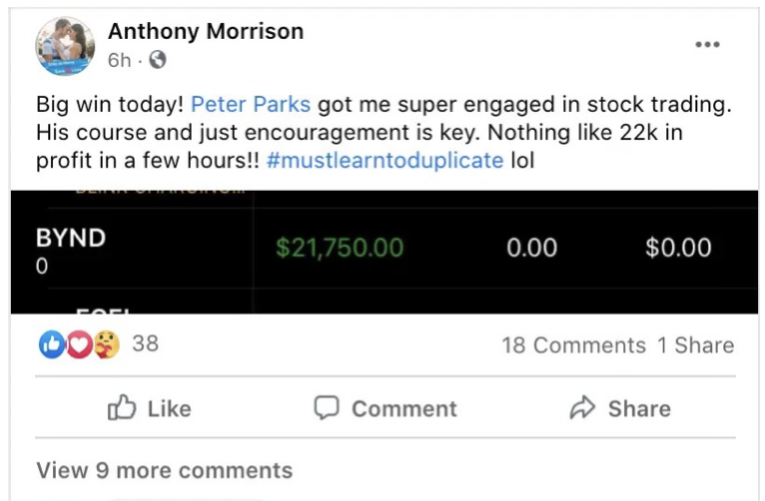

Let me show you my live trading account below, so you see I'm for real and can show you how to be a profitable trader.

Not too many option traders and stock traders would show you their live accounts.

Check it out below.

Watch As I Login Live To My Trading Account Below So That You Can See The Possibilities of What You Can Do Part Time Trading.

I figure its important for you to see compliance, to show you I'm one of the few real options traders and stock traders out there who doesn't have a huge YouTube® channel or huge social media channel but who actually trades in real time pretty much every day...(or whenever I want)

OK, Want To See More? Because I Always Want To Over Deliver To You.

Here Is Our Full Step By Step Trading System Laid Out Inside Of Our Fully Optimized Secure Membership Site Portal (That you can get instant access to when you become a Platinum Trader Beta Tester 2.0 Member.)

There Is Too Much To Discuss All In This Section, So The Best Way Is To Watch The Members Area Video Below, Then Click The Button To Get Immediate Access.

The Platinum Traders Beta Testers 2.0 Membership Area

-

-

Inside the Platinum Traders Beta Testers 2.0 Group, you get the privilege and right to watch how to trade with real-time text alerts sent directly to your smartphone, weekly group coaching calls, and to follow along with my options trading and stock trading journey with a full-blown membership site.

So, once again, I have to reiterate, I am not a licensed broker-dealer, I have no certification anywhere with any recognized or certified regulatory body with regards to stock trading and option trading.

I cannot legally give you any financial, tax, legal, or investment advice because I am not certified or licensed.

I'm just a humble guy who has a passion for learning the stock market and option market game and has a knack for finding good stock plays.

So that you completely understand that you are more than welcome to join our growing membership of like-minded cool entrepreneurs.

Inside the group, you'll watch my methodology and the step by step system laid out and see how I...

1. Conduct Research

2. Use indictors

3. Talk through the trade...ie. "if this happens I'll do that"

4. Place the trade and how I set up the monitoring

5. Order executionI'm going to keep it simple, because I'm a simple guy, so I'm not even going to try to pretend and use the stock or options trading vernacular that I still don't even know, lol

I'm just going to talk to you straight like your right next to me.

I'm still a newbie...(in my opinion, only 2 years in) options trader and proud of it 😉

What Has Option Trading And Stock Trading Been Able To Do For Me?

First Class Travel For My Family 4 Times A Year And Most Of The Winter...(Before You Know What Struck)

One Of My Homes...(come take a look inside, I'll give you a tour. Click the video below, that's if your interested in seeing where I work)

The Platinum Traders Beta Testers Group 2.0 Mega Course With The All New Quant Style Trade Driven System Included Today.

Before you get started with the Platinum Trader Beta Testers 2.0 System, I want to be crystal clear... If you want to make significantly more option trading and stock trading gains (I'm talking life-changing results) then you need to step up and make it happen. Please see our disclaimers*

Listen, I'm an intraday momentum options and stock scalper.

I trade using price action, volume, position, size, and leverage it.

I scale in with size and scale out with size, taking my profits all the way up, leaving very little meat on the bone at the end, so I'm constantly coming out in the green....(There's another trading tip for ya)

Yes, I can make as much as I want in a day compared to any day trader, any swing trader, or any long-term trader. investor holding for months...(I've done it multiple times.)

I'm an intra-day momentum options and stock scalper.

I do not have to be held hostage or be at the mercy of the market because I'm holding long term and have to sit there with my hands tied behind my back, waiting and praying for my portfolio to bounce back, or have to liquidate and-eat massive losses because the market crashed and so did-my long term hopes and dreams.

I take ACTION.

Every single day on my terms.

Work when I want to, get into and out of the market when I want.

I'm not left holding the bag when the institutional players, Wall Street, and the algos decide to drive the price of the stock down and take a massive dump on you, while you are left holding the bag...

...(aka you are known as the bag holder.)

There is no shame at all being an intra-day momentum options and stock scalper.

Matter of fact, it's one of the highest levels of trading.

You have to be on your game all the time when you trade, you gotta see moves being made before the move is happening and get in there to ride it.

You gotta crunch and analyze data fast and have the tools and skill to make the call.

And a whole bunch of other variables that I haven't even gone into.

But wait, all that being said, you don't have to worry because my team and I do most of the heavy lifting.

If you have a cell phone or email, we send the goodness to you in trade alerts.

The choice is yours whether or not you take the trade.

When I enter into the stock market every day, I want my money today so I can go back into the market at will when I want to scale into a trade again and again and again, taking advantage of the moves with leverage, position, and size.

OK, so you might ask, "well don't you have to pay a premium to get into a higher priced stock that has been appreciating for awhile to get into the trade?"

My answer..."sure, but you also realize when I'm getting in and paying that premium, I'm also getting out selling it at a higher premium with none of the downside. I'm still in and out at the higher highs and selling those highs" (yea another trading tip for ya)

So, when the trend is over and the stock takes a bad beat over bad news or some crazy bad catalyst and loses 10% or more in a day, then trends downwards for days or weeks afterward, then I'm the bag holder, I gotta then sit there "holding the bag eating the loss waiting for it to recover"

I'd Like To Introduce You To The Platinum Traders Beta Testers Group 2.0...(Growth Partners For Life.) And Welcome You With Open Arms.

For those of you who are interested in getting Inside the Platinum Traders Beta Testers Group 2.0 only paid members will be able to share the behind-the-scenes strategies and trade setups that entitle you to know how the option trading machine works.

Unlike most of these stock trading and option trading "gurus" out there who don't even trade in "real time" and flounder, I put my cold hard $ on the line every day.

That is the difference.

Now I'm not saying I'm going to be teaching this. As a matter of fact, I won't be teaching for legal reasons.

Inside the Platinum Traders Beta Testers Group, you get the privilege and right to watch how to trade with real-time text alerts sent directly to your smartphone, weekly group coaching calls, and to follow along with my options trading and stock trading journey with a full blown membership site.

So, once again, I have to reiterate, I am not a licensed broker-dealer, I have no certification anywhere with any recognized or certified body with regards to stock trading and option trading.

I cannot legally give you any financial, tax, legal, or investment advice because I am not certified or licensed.

I'm just a humble guy who has a passion for learning the stock market and option market game and has a knack for finding good stock plays.

So that you completely understand that you are more than welcome to join our growing membership of like-minded cool entrepreneurs.

Inside the group, you'll watch my methodology and the step by step system laid out and see how I...

1. Conduct Research

2. Use indictors

3. Talk through the trade...ie. "if this happens I'll do that"

4. Place the trade and how I set up the monitoring

5. Order execution

I'm going to keep it simple, because I'm a simple guy, so I'm not even going to try to pretend and use the stock or options trading vernacular that I still don't even know, lol

I'm just going to talk to you straight like your right next to me.

You see, that's how these "stock and options gurus" get you, they confuse the crap out of you 🤔 with these phrases and terms, and words, that just add to the noise and make more noise and give you more stuff to learn while you sit there and lose money...

...(Yea I went down that road and told myself, lesson learnt, and thought...why can't you make it simple and just talk to me.)

And that's what the options and stock market is all about, keeping it simple.

So, with that being said, I bet you would like to see what's under the hood as far as the modules if you didn't watch the video where the members' area has been updated.

-

You will see and hear me talk about the trade and what I intend to do. (inside some of the modules and coaching calls)

-

You make the choice after doing your due diligence because it's your money, and figure out whether or not you are going to follow along and place the trade

-

I send out real-time text alerts for all the trades I take... the service I use works pretty much everywhere in the world so far, except in certain parts of the UAE due to local carrier restrictions and certain parts of India.

-

The fact that I can make these winning trades over 93% of the time and do it in these crazy volatile market times like we're in now should let you know that you are in more than capable hands.

-

Imagine when things turn around and the markets pick back up and there's nothing but upside what we'll be doing, lol (I'm secretly licking my chops for that)

You are extremely important to me and my team. So, in the video above, transparency is the key.

-

What separates this information is that it’s based on real world strategies, systems, is rule based without emotions and driven by success with real people, real option traders and real stock traders.

Module #1 - What Are Options And The Power Of Using Them To Win Or Lose...(Don't worry I show you how to win while others lose.)

-

1. What are options...(I explain options for dummies and broken down in plain english)

-

2. what is an option contract and how to leverage it

-

3. Advantages of leveraging options vs stocks and why you want to use either or

-

4. How to use options as income

Now as you know you are going to be looking over my shoulder while I trade in real time so as we progress we'll get more into the nuances of options and you see me work through it in real time and talk about it.

Module #2 - How To Maximize And Profit From "Calls" and "Puts"

-

In this module we go over "Calls" and "Puts" what they are and how to use them and why you should use them when you are options trading.

There are many strategies to leveraging options with "calls" and "puts" and we'll cover a couple which are...

-

1. Income

2. Hedging

3. Risk

-

This is a great module and you'll see in real time how I use calls and puts.

I've attached a PDF for this module along with the video so you can get a solid understanding.

Now, as you know, you are going to be looking over my shoulder while I trade in real time, so as we progress, we'll get more into the nuances of calls and puts as I work through each one and explain why I'm trading.

Module #3 - "In the Money Out Of The Money"

-

In this module we go over...

1. In the money VS out of the money options - what are they

-

2. When to use in the money or out of the money options.

-

3. How to profit with ITM (In the money) and OTM (Out of the money) calls and puts

-

4. How to figure out "volume" and "open interest" to take advantage of ITM and OTM action.

-

5. How to figure out your "delta" which is one of the most important greeks for options, and how it works to take advantage of your option contract.

Now, as you know, you are going to be looking over my shoulder while I trade in real time, so as we progress we'll get more into the nuances of ITM and OTM action as I work through each one and explain why I'm trading.

Module #4 - Execution Of ITM And OTM

In this module we go through step by step and you're going to learn...

-

1. in real time how to leverage ITM and OTM option plays

-

2. Why to use ITM and OTM options and strike prices

-

3. When to take your profits while the stock and option are still trending

-

4. How to look for ""implied volatility and use it to your advantage with ITM and OTM option plays

-

5. Why "open interest" and "volume" play a big role in determining how fast ITM and OTM options will either make you money or you'll lose your shirt.

And much much more, this is a large module but a good one to get you thinking about how to best leverage ITM and OTM options.

Now, as you know, you are going to be looking over my shoulder while I trade in real time, so as we progress, we'll get more into the nuances of ITM and OTM options plays as I work through each one and explain why I'm trading.

I've included a PDF that further goes over "Calls and Puts" in a PDF Part 3 and, mastering the essentials, scroll down to download it.

Module #5 - How To Hunt Down Launch Pad Options

In this module we're going to go over...

-

1. Finding Stocks And Options That Are Ready To Explode To The Upside Or Downside

-

2. Understanding the "hunting" and "launch Pad" formula

-

3. Seeing how to put the "rocket ship" or the "ski slope" pattern to use and knowing what to look for

-

4. the indicators that will make or break your options trade and how to set it all up

-

5. What to do to get your order "filled" and how to "exit" the option trade for profit

and a lot more.

Now, as you know, you are going to be looking over my shoulder while I trade in real time, so as we progress, we'll get more into the nuances of really setting up these "launch Pad" options and stock plays and why, after you finish this course, you can do it for yourself.

I've included a PDF here for you as well, so you can see why this is repeatable.

Module #6 - Profitable Platform Indictors

-

In this module we cover...

-

How to set up your custom indicators to be able to make profitable plays with options and stocks

-

how to follow the trends, what to look for when your hunting for the Launch Pad options and stock plays

-

You see step by step some of the processes I go through to pick stocks that will either uptrend or downtrend and I'll show you the setup to take advantage of it.

-

Just by using this formula alone, you can now profit at will with your options or stock plays.

Now, as you know, you are going to be looking over my shoulder while I trade in real time, so as we progress, we'll get more into the nuances of how I will call out the options and stock play for you over the next few months, so you really don't have to do a lot of work. I'll do most of it for you.

Module #7 - Vertical Spreads (Maximum Profit VS Minimal Risk)

-

So we’re going to go over the strategy of the vertical spread. It is one of the most advanced trades you can start to make with spreads. But once you learn them, you will learn how to mitigate your risk and maximize your profit potential.

-

For this module it was important to give you a PDF for this that goes over the spread a bit more. But at the end of the day, I'll be doing the trading and you will be piggybacking off all my trades...(if you want, remember it's up to you how you trade.

I can't tell you what to do or advise you) so don't sweat the vertical too much.

As long as you have a foundation as to what to look for, you can learn more about it, and we'll go over it later for sure.

-

And I did forget to include my disclaimer in this video but you know it still applies. I can't offer any legal, tax, financial, investment advice, I'm not certified or licensed to do so...(Just thought we'd be very clear on this point for liability reasons)

Module #8 - Staircases And Ski Slopes

In this module you will learn...

-

The rules and patterns to look for when it comes to staircases and ski slopes

-

The parameters and criteria for looking for ski slopes and staircases.

These rules are here in order for this to work for you for the maximum effect.

-

The criteria and parameters in regards to liquidity, prices, small cap, mid cap, large cap stocks, for looking for the ideal stocks to be able to find ski slopes and staircases

Automation template

-

In this module we'll be going over some strategies and tactics for setting up your automation.

-

Alright, this is what a lot of members have been asking for when it comes to knowing how to set up order entry and exit on automation aka (You don't want to be glued to your screen all day long)

-

I go over what you need to do when you want to put orders in with calls, puts, spreads.

-

How to set up your order entry so it works with automation and you put it all together with exiting for profit, setting up your profit and stop loss.

-

Now I go over how it's set up In my trading application, but you can follow along with your trading application and/or simply call your trading platform customer support and they will or should gladly help you set it up or give you instructional video on how to set it up.

What Our Platinum Traders Beta Testers Group Members say:

Juan Walker - Turn On Sound To Hear Video

More Incredible Platinum Traders Beta Testers Group Modules

-

Module -8 Staircases And Ski Slopes

-

In this module you will learn...

-

The rules and patterns to look for when it comes to staircases and ski slopes

-

The parameters and criteria for looking for ski slopes and staircases.

These rules are here in order for this to work for you for the maximum effect.

-

The criteria and parameters in regards to liquidity, prices, small cap, mid cap, large cap stocks, for looking for the ideal stocks to be able to find ski slopes and staircases

-

-

The Master Handbook For Helpful Strategies For Your Options Trading

-

* How to set up your unusual option activity scanner for free and not have to pay $100's of dollars per month for services

The scanner filters you need to set up as a guideline when to enter and exit the trades with profit and loss parameters.

-

Real Market Conditions And clarification on the entry and exit of stocks and what you need to look out for with option entry and exit as well.

-

The best resources for getting real-time intel, earnings, breaking catalyst events, live trades...using social media as your weapon of choice.

-

and much much more...

-

-

Set Up Automation For Your Orders

This is one of the most efficient ways to run your business, so in this updated module, you'll learn...

-

we go over how to set up your orders with the automation template so you can set it and forget if you do not want to be chained to your computer.

-

***Warning, using these templates may stop you out short and early from ever taking profits in very volatile conditions with your options, but it is also a safe way of knowing that you stay disciplined and not have to worry about your positions.***(For Intermediary and advanced traders)

-

As you go through the course and you gain more experience, you can start to develop your own style for what your risk tolerance is for profit and loss and set up your templates accordingly.

-

-

New! Version 2.0 Quant System Setup #1

Live Trading +90%

This is one of the most efficient ways to run your business, so in this updated module, you'll learn...

-

we go over how to set up your orders with the automation template so you can set it and forget if you do not want to be chained to your computer.

-

***Warning, using these templates may stop you out short and early from ever taking profits in very volatile conditions with your options but it is also a safe way of knowing that you stay disciplined and not have to worry about your positions.***(For Intermediary and advanced traders)

-

As you go through the course and you gain more experience, you can start to develop your own style for what your risk tolerance is for profit and loss and set up your templates accordingly.

-

-

New! Version 2.0 Quant System Setup#2

Using Credit Spreads

In this module I go over my second system setup used by institutional firms, hedge funds, money mangers, prop firms.

This is a quant driven system and study setup that is one of the best for highly liquid stocks with volatility and mid to large cap stocks.

-

I'm using the main high probability study set up which is the Volume Profile, Chande momentum oscillator, and the MACD for predictable results.

-

I also go over a strategy that works extremely great with this quant set up, which is using the credit call spread.

This is a highly detailed module so you need to please watch it at least one or two times so you understand how to use this setup and strategy to look at results vs failure...**(Again, no income claims just better strategies to help you in your trading)

-

Some of the advantages of using the credit call spread are...

* Credit Call Spreads can gain momentum with the premium if the stock goes down, or the stock trades stays the same and/or trades sideways in a box or channel, or the stock goes up. There is no directional bias that you need for this strategy.

* The credit call spread is a limited risk or risk defined type strategy vs using the naked call, if you are more of a contrarian or conservative type trader who is looking to make a day or swing trade and hold the position for a couple of days leading into expiration.

* The credit call spread can improve the odds in some cases, so you become like the house or the casino.

* The credit call spread allows you to get paid to take risk to enter the trade ie. you collect premium upfront.

***(I'm actually teaching you something here in these modules if you pay close attention, giving you strategies to think about even before you buy the course)

-

-

New! Version 2.0 Covered Call Income Generation

In this module you'll learn...

-

About the cover call and why some think about it as a conservative strategy, but when you do it right it is a great income-generating strategy and volatile markets.

-

If you play the strategy correctly, it can be very lucrative because what you want to do is use the strategy when there's high implied volatility...(Again, your learning something even before you buy the course)

-

In-depth Criteria and parameters and different strategies and using this particular income-generating option play

-

-

New! Version 2.0 Sniper Scanning 2.0

In this module I show you...

-

step-by-step-how to find the highest probability-profitable trade set-ups with any type of stock.

This is the module that a lot of members have requested because they always ask me...

..."how do I find a lot of winning trades? How am I in the position to ride the momentum either to the upside or the downside for the trade?"

-

There are many different ways to find trades. Lots of different traders use news, they use social media, they use friends, they use groups.

But one of the best ways to do it is to play like the institutional firms and the prop trade firms and that’s using the tools that the algos and the quants use.

-

You'll learn...

1. How to set up your scan to be in the best position possible to find the best trades using the weekly, daily and intra-day timeframes.

-

2. How to make sure you have the proper liquidity in your trades so entry and exit is not only profitable but timely executed.

-

3. How to find your momentum trades so you are in and out in a matter of minutes.

-

4. How to build a swing trade position or weekly trade position based on the set-up.

-

5. What indictors and use and how to evaluate the entire setup to know whether or not its a bullish or bearish position.

-

6. How to use the scanner to set up your trade to either trade calls, puts, credit spreads or put spreads and why.

-

7. And much much more... This is a highly detailed video. You need to get inside the membership to watch the video.

-

-

New! Version 2.0 Advanced Order Execution 2.0

-

In this module we go over advanced order execution 2.0...

You're going to learn in this module how to hold the option chain hostage so that institutional firms proprietary firms quant firms, hedge fund managers and money managers can't make a move without you making a move first and, the option chain.

-

* You're going to learn the exact skill set in the exact criteria necessary to be able to make sure that you get your orders filled with the best possible execution so you don't lose any money and your profits far exceed the rest of the marketplace.

-

* You are going to learn how to use last X (price order execution) as your weapon of choice and how to get the best order fill for a market order even if you're not using a limit order.

-

* You'll also learn exactly how to control the order flow and use it to your advantage so that you can tie up an entire option chain and get the best price possible so all you get your order executed first while others lineup in the queue

-

-

How To Find The Best Setup To Scale The Trades

In this module I do something a little different...

-

I wanted you to see how I would take the trades if I did take the trade and I walked you through the foundation of what I do in live market conditions.

As if I'm sitting right beside you I walk you through it.

-

I took this trade with the intent of showing you how you can make money no matter what the conditions...*(Please read my income disclaimer. This is not typical. I do not know what your results could or could not be) are, so it was more along the lines of walking you through live trading conditions in the other live video, then with this video show you the practical application of taking the trade live and spending money.

-

See how that works?

*You'll see how to deal with a super tight support and resistance level.

*How to deal with chop ie. prices fluctuating within a tight range in some points 10 cents or more.

*How to deal with increasing and decreasing volume and when to pull the trigger for your entry and exits

*What to look for when you are reading level II, reading candles, and reading the active trader ladder.

*and much much more.

-

-

Who controls the markets?

-

You get to see exactly how the market is set up. Why the institutional players are why they hedge funds why the proprietary firms do what they deem

-

You get to see how the market makers set up the current option chains and how they do their pricing so it plays into their favour and what you can do to take advantage of it all.

-

You'll learn how to use some of the most effective tools on the market and you'll see some of the strategies behind the tools so that it can help you to be a better trader and put you in a better position in the drivers' seat.

-

-

How To Play Options Before And After Earnings Calls

-

In this module I explain to you a couple of principles of how to play options before the earnings call.

-

Why you want to play the options leading into earnings and exiting out of the trades at least 2 to 3 days before the earnings call. *hint hint*

see your learning more content even before you buy the course. (its about delivering before you buy)

-

How to see how the big institutional players are hedging their positions before earnings come out and after earnings come out and what you need to do about it.

-

You'll see the criteria and the parameters that surround options and how to play earnings before and after and why there are advantages and disadvantages to both.

-

-

Trader mindset And Trading Plan

-

This is one of the most important modules.When it comes to executing a trading plan and staying out of trouble.

-

You will learn in-depth in a no-nonsense way how to set up your complete trading plan with criteria to parameters completely broken down for you step by step.

-

There is no fluff or theory. This is all laid out in a strategic fashion.

The most important part to remember is following your trading plan and work the plan then let automation do the rest.

-

-

Stock And Option Formula

-

This is one of the most important modules.When it comes to executing a trading plan and staying out of trouble.

-

You will learn in-depth in a no-nonsense way how to set up your complete trading plan with criteria to parameters completely broken down for you step by step.

-

There is no fluff or theory. This is all laid out in a strategic fashion.

The most important part to remember is following your trading plan and work the plan then let automation do the rest.

-

-

Platinum Traders Beta Testers Group Live Coaching Calls & Replays

-

This is worth more than the actual course itself included for you.

-

This is the entire vault of the platinum traders live coaching calls and the replays.

Inside these live coaching calls they are at least at a minimum of an hour to two hours long.

Every single one of them is packed and I mean jam packed with every type of information that you can possibly think about when it comes to options in stocks

-

Inside these coaching calls we go over some of the live trades of the week, we go over what happened as far as the wins and the losses, we go over how to avoid getting into the situation again and what to look out for these calls are jam packed.

-

Lots of processes to work with in this live coaching call replay, if you are looking to go long or go short with stocks, if you are looking to go long or short with the options I go over trade analysis and how to position your setups.

-

You need to know what your numbers are, if you do not you won't know where you are in the trade.

We go over how to set up the trading application back office to see where numbers are.

-

We go over how to scan for stocks that will gap up over the weekend to be ready to roll out strong on Monday morning and how to set up the filters to look for it.

We go over the "call and put" strategy vs the "spread" strategy and why you would want to do either or and benefits and risk

-

I went through the psychology for picking stocks and what to look out for when you are getting into the trade.

-

and much much more

-

-

The Platinum Traders Beta Testers Group Questions And Answers Resources For Options

-

TTM_Squeeze How To Maximize your high probability setups

-

"PDT Rule Workaround" Pros and Cons and compliant ways to increase your edge.

-

IPO Calendars And how to take advantage of them.

-

Running Quant Driven Scans To Find Stocks & Options

-

The criteria and parameters to measuring volatility with small Medium camp and large-cap stocks and how do use options to your advantage

-

SECURE ORDER, PLEASE SCROLL DOWN TO GET ACCESS

And There You Have It, It's A Beast Of A Trading Course. The Platinum Traders Beta Testers Group 2.0 Course With The All New Quant Style Trade Driven System Included.

This Is All Yours For One payment of $2997

then $697 per month...(Stay as long as you feel I'm providing the value to you, leave whenever you want.)

Just so you know the fantastic deal you're getting, the regular price for this course is $3997 then $697 per month and its sold at that price every day.

Its been successfully selling at that price point since April 2020 and I've now gone and updated the course to version 2.0 and now including version 3.0 which is hot off the presses to reflect what's going on in todays market, aka RIGHT NOW so today, today only you get it...(Well, for the next few hours at least) you get it for $2997 then $697 per month.

If you leave empty handed now and come back later, and the timer is at zero you will being paying the regular price of $3997 then $697 per month, so act today to get this fantastic deal in your hands now.

We hate SPAM and promise to keep your email address safe.

Look, I make no bones about how I trade.

I trade aggressively and I trade smartly.

I'm an intraday momentum options and stock trader scalper.

I trade using price action, volume, position, size, and leverage it.

I scale in with size and scale out with size, taking my profits all the way up, leaving very little meat on the bone at the end, so I'm constantly coming out in the green....(There's another trading tip for ya)

Yes, I can make as much as I want in a day compared to any day trader, any swing trader, or any long-term trader. investor holding for months...(I've done it multiple times.)

I'm an intra-day momentum options and stock scalper.

I do not have to be held hostage or be at the mercy of the market because I'm holding long term and have to sit there with my hands tied behind my back, waiting and praying for my portfolio to bounce back, or have to liquidate and-eat massive losses because the market crashed and so did-my long term hopes and dreams.

I take ACTION.

Every single day on my terms.

Work when I want to, get into and out of the market when I want.

I'm not left holding the bag when the institutional players, Wall Street, and the algos decide to drive the price of the stock down and take a massive dump on you, while you are left holding the bag...

...(aka you are known as the bag holder.)

There is no shame at all being an intra-day momentum options and stock scalper.

Matter of fact, it's one of the highest levels of trading.

You have to be on your game all the time when you trade, you gotta see moves being made before the move is happening and get in there to ride it.

You gotta crunch and analyze data fast and have the tools and skill to make the call.

And a whole bunch of other variables that I haven't even gone into.

But wait, all that being said, you don't have to worry because my team and I do most of the heavy lifting.

If you have a cell phone or email, we send the goodness to you in trade alerts.

The choice is yours whether or not you take the trade.

When I enter into the stock market every day, I want my money today so I can go back into the market at will when I want to scale into a trade again and again and again, taking advantage of the moves with leverage, position, and size.

OK, so you might ask, "well don't you have to pay a premium to get into a higher priced stock that has been appreciating for awhile to get into the trade?"

My answer..."sure, but you also realize when I'm getting in and paying that premium, I'm also getting out selling it at a higher premium with none of the downside. I'm still in and out at the higher highs and selling those highs" (yea another trading tip for ya)

So, when the trend is over and the stock takes a bad beat over bad news or some crazy bad catalyst and loses 10% or more in a day, then trends downwards for days or weeks afterward, then I'm the bag holder, I gotta then sit there "holding the bag eating the loss waiting for it to recover"

That being said, if you like my style of trading...(You can also get the system customized to your style of trading) and within 30 days I'm not able to double or triple your account, you can ask for your money back, 1000%

All The Risk Is On Me, Not You. You Get To Learn For The Next 30 Days For Free And Steal All My I.P And Secrets...(If you were that type of person, which I know your not)

Frequently asked questions

These are some of the most frequently asked questions and I have answers for you.

I want to join your beta testing group, how much money will I need to start trading with and how many hours per day/week realistically, try to balance my time with my other job?

Investment to trade will depend on your risk tolerance. You could start with a $500 trading account and test small.

Hours and days are totally up to you, it's your dime.

I trade daily...I love...it

As a ball park figure, what sort of money will it take to start Trading?

You can start with as little as $100 depending on where you go and scale from there by reinvesting your profits back into your trades like I did. That is how you reach scale so fast. You do not pull any money out of your trading account, you scale it up fast. Then when you reach a good point where you are comfortable, you pull money out of your account.

What strategies do you use? Covered calls, verticals? other?

98% of my strategies are debit spreads and credit spreads.

I do "calls" and "puts" as well and sell a lot of premium.

Options trading for my Platinum Trader Beta Testers Group is about keeping things simple and not thinking your smarter than the market.

1. Which type of account do we open to trade options, like Double P? a. Individual? b. LLC? 2. Do we open a TD Ameritrade account or a Think OR Swim account?

It is up to you to open the account that makes sense to you. We can'Dout legally recommend one to you because everyone has different requirements.

All of Double P's accounts are different corporate accounts because he trades at an institutional level.

TD Ameritrade comes with both versions that are included.

Please contact them and they can assist you further.

And you can open an brokerage account it doesn't have to be with TD Ameritrade or think or swim. Most major brokerages have the same or similar chart and indictor packages and the option chain is universal. Some brokerages may have better routing or pricing but its mostly comes down to the liquidity providers and market makers.

Q. What is the focus of Double P trading is intra-day scalping, day trading, swing trading, long term investing?

A. Double P does all the above and goes into all areas of trading inside the course. You must understand, depending on your brokerage, you can utilize double P's trade alerts and there is a possibility of being flagged in your brokerage account as a PDT (pattern day trader) but there are very compliant and legal workarounds to being able to intraday trade.

Do you place a Contingent order to STC when the 20% profit is achieved? or do you constantly monitor the trade and manually sell the Puts once you get the 20% profit? Thanks

All depends on many factors, most times depending on what I'm trading I already set up my exit so I'm not staring at a screen all day, its crazy doing that

What % do you risk per trade on average?

it all depends on how passive or aggressive get with the trade and the environment

What options broker do you use?

Best I can tell you is...

1. do your due diligence, call the big ones in the space and ask a ton of questions of their customer support until they are sick of hearing from you and send you a whole wack of resources kickass resources,...(that's what I did)

2. Do a lot of research on google and YouTube after you get resources from the big dogs and see what both sides are saying...(that's what I did)

3. Pick your broker and test small and call their live support while trading and make sure they help you along with your trading until you are comfortable going off on your own.(that's what I did)

You now have the some of the foundation of exactly what I did to get successful with options trading😉

No experience necessary? Can this be used globally?

I'm global so yes works anywhere in the world.

You just have to account for time zone changes like I do.

This is a very long Q&A response please read in full.

Q. Is your course available:

A. Yes its available on a case by case basis, there are some conditions you need to understand and agree to.

its $997 and $397 per month with no payment plan and the course will soon go up to $1997 and $397 per month and has been that way since I took on a small beta tester group back in April and the cost will be increasing to $1997 and $397 per month soon with the same no payment plan.

Got lots of members making incredible money now so price is going up and I'm relaunching this course with the help of a friend soon.

And yes I've got a couple of members who are struggling and puttering along for whatever reason but they haven't caved in yet. Its not everyone's cup of tea, you have to have brass balls of steel to put money into the options market. the couple of members who are struggling have very tiny accounts so one trade going sideways on them could wipe them out. Just being straight, there is no guru here trying to fill your head full of shit, I'm telling it to you straight.

Q. Does my religion not allow me to trade options or stocks?

A. Understand your religion may preclude you from trading options or stocks...(Yes if you are of the islamic faith you cannot trade options...or you shouldn't so understand that before you buy)

Q. What do you teach in your options trading course?

A. I teach mostly everything there is to do with options trading, which includes buying and selling calls puts, spreads, etc etc etc

I also teach stock trading, going long, shorting, etc etc etc

Its day, momentum, intra day, swing trading, etc etc etc we get into a little bit of it all.

If you need to get caught up on the terminology then go to YouTube® and do a search for all the terms and watch the videos for a general intro to options trading and stock trading.

My course might not be right for you if you have never traded a option or stock before but my course is super simple and I keep it down to the bare bones basics and foundational stuff, nothing exotic or fancy like these other gurus who try to confuse the shit out of you…(Just being straight)

Q Is there a Facebook Group?

A. There is no Facebook™ group and never will be one.

I don’t control FB™ platform so for me to put all my content on FB™ and for them to maybe one day say this group isn’t cool anymore and shut it down I would have just lost all my hard created content so for that reason no FB group.

Q. What do I get inside of your course and program?

A. You get a full blown membership site where all the content is housed. You get live weekly coaching calls, you get access to real time text alerts for trading sent right to your smartphones and the most important, you get direct access to my brain in regards to trading.

You stay with me for 6 months in 6 months time you get access to all my custom scripts, customer indictors, software application set up, etc etc etc

Those who have been with me already since April they only have to wait until August and they get it all.

I'm not releasing any of my custom indictors, scripts, charts, to anyone only to have them try and cancel 30 days later and take what I've spent thousands of dollars on to get done for my trading app then for you to walk away with it.

Not happening.

Before you buy understand there is no refund, no chargeback, you can cancel whenever you want those are parts of the terms and conditions inside of the TOS policy so read it.

You stay with the group for 6 months thats when I release all my custom indictors, scripts, charts, etc etc etc not before so don’t ask.

Q. How can I contact you?

A. If you buy please don't post any questions here in my social inbox.

I have to keep everything documented and verified for everyones safety.

My guys (my VA’s) are monitoring my social inbox and are instructed to delete any support ticket or options or stock questions in my social inbox so please post all questions and stock related stuff to the help desk or inside the members area if you are to buy the course and you will be looked after.

Q. Does your option and stock trading strategy work in my part of the world?

A. I have at the time of writing this post today 197 people inside the course from pretty much every country, Russia, Thailand, New Zealand, Australia, USA, UK, Spain, Bulgaria, Poland, Germany, turkey, Bali, China, Maylasia, Canada, Brazil, Hong Kong, Singapore, Iceland, Israel, Bahamas, Vietnam, India, so I'd say my strategies can work yes.

Money doesn’t sleep, but the USA Stock Markets are open from 9:30am to 4pm EST thats when we trade.

I also trade premarket and after hours at well...(You don't have to it comes at a premium)

Q. What broker can I use for where I live?

A. I don't know who uses what broker, and its not my job to know, its virtually impossible.

I can't recommend any brokerage firms as well for compliance reasons.

You'll need to do your research to figure what to do from your end.

I knew once I opened up my program that would be one of the questions people ask as far as what broker can I use, and will this work in this country or that country, or is this broker better than that broker etc etc etc and thats just a big nasty hole to crawl down so that is something for you to do on your end.

There are thousands and thousands of brokers globally no way I'm getting into that to sort through them.

Just being super upfront with you so there is no misunderstanding and you know exactly what the terms are before you buy.

If you understand all the terms and conditions and want to move forward click the link above to get to the shopping cart for the course.

if not you don't agree with the terms then that's cool no worries I wish you well.

Q. do you start your day when the markets open no matter where you are in the world? Or do you keep your “normal” schedule? Ex. Do you make sure you are awake and in your account for the 9AM Est opening bell?

A. I start my trading 30mins before the market opens up and/or the night before as well to get a good look at what happened.

Q. And you trade it's all done mostly on your phone?

A. Yes I do all of my trading from my phone but when I open up the membership site I will be doing it from my laptop so that you can see it better

Q. What time frames do you use, eg, daily chart?

A. 60, 30, 15, 5, 2

Q. How should I analyse the market?

A. There are a few different ways to do this...

1. have a well defined support and resistance zone to help guide you.

2. Have some solid technical, fundamental and sentiment analysis or just use my system that will help show you the way.

3.And lastly know that certain times offer better profit opportunities than others. This is especially true when you are day trading and scalping because you set yourself up to a large number of trades.

Thank you.

This site is not a part of Google™ website or network of sites such as Youtube™ or any company wholly owned by Google™ or Youtube™

Additionally, this website is not endorsed by Google™ Youtube™ In any way. Google™ is a trademark for all of their respective companies.

At the end of you providing your email address, you’ll be taking to another page and I’ll be making an offer. The offer is for my course and membership in analyzing the stock market. The course is $2997 upfront, then $697 per month recurring subscription. You can find all the details on the next page or by clicking below on our main link. You can cancel within your first 30 days for a full refund.

ABOUT THE FREE TRAINING: On the next page I’ll be making an offer for people who want to have access to a program that will help implement what they learn on the case study above and on the next page and more. This is completely optional. The free training video lasts about 15 to 20 minutes and if you don’t want the program, you can leave without buying anything.

You can stay as long as you want. Please understand that during this free video training where I'm providing you a ton of valuable insights into stock trading, and showing you direct actionable strategies and techniques to grow your business, I’ll be making an offer to you and to anyone who wants to continue to receive help from my team and implementing everything that you have learnt on this video training today. It's completely optional…Either way, the training video you’ll be watching offers a TON of value - no strings attached and you’ll be more than happy if you take me up on the offer to help you with your business.

DISCLAIMER: Due to some of the FTC guidelines, The Federal Trade Commission’s newly revised Guidelines Concerning the Use of Endorsements and Testimonials in Advertising, which became effective December 1, 2009, require the following disclaimer and/or disclosures with regard to the endorsements and testimonials included in this site: We don't believe in get rich programs - only in hard work, adding value and taking action with real strategies that can get you results. Our education is intended to show you proven strategies personally used by Peter and students globally to effectively invest in today's education and business market. As stipulated by law, we can not and do not make any guarantees about your ability to get results or earn any money with our ideas, information, tools or strategies.

*INCOME DISCLAIMER : Earnings and income representations made by Platinum Option Traders, Platinum Traders Beta Testers Group, Peter Parks, Strategic Mentoring, Advanced marketing wealth solutions Inc, and strategic DFC Consulting LLC and their advertisers/sponsors (collectively, “Peter Parks” "Advanced Marketing Wealth Solutions Inc" "Strategic DFC Consulting") are aspirational statements only of your earnings potential. These results are not typical and results will vary. The results on this page are OUR results and from years of testing. We can in NO way guarantee you will get similar results. Any sales figures stated above are our personal sales figures and those of students that worked extremely hard,and being a compliant direct response advertiser, some of the sales figures and/or claims stated above with the case studies are those of my own personal sales figures and/or those of some of my clients who have substantiated and verified their own financial numbers through 3rd party merchant accounts and their own financial teams.

*INCOME DISCLAIMER : This website and the items it distributes contain business strategies, marketing methods and other business advice that, regardless of my own results and experience, may not produce the same results (or any results) for you. my companies, makes absolutely no guarantee, expressed or implied, that by following the advice or content available from this web site you will make any money or improve current profits in the stock trading or option trading market, as there are multiple factors and variables that come into play regarding any given market condition. Primarily, results will depend on the nature of the market, the strategies you use and the overall conditions of the marketplace, the experience of the individual, and situations and elements that are beyond your control. As with any stock market or option market endeavor, you assume all risk related to investment and money based on your own discretion and at your own potential expense.

REFUND POLICY: The public price of the Platinum Traders Beta Testers Group course and membership video training course is $997 then $397 per month with recurring billing. Platinum Traders Beta Testers Group course and membership video training course complies with the Magnuson-Moss Warranty Act (full document, backup) in the warranty (aka Refund Policy) that it offers consumers of its product's. The full text of the refund policy is available online by clicking here.

Please understand my results or those of my clients and students are not typical. I’m not implying you’ll duplicate them (or do anything for that matter). I have the benefit of practicing stock trading, option trading, direct response marketing and advertising since 2001 and have an established large social media and social networking following as a result. The average person who buys any “how to” information gets little to no results, the average person who buys any financial education product gets little to no results and the average person who buys any stock trading, or option trading or any trading course or product experiences very little and next to no results.

I’m using these references and/or case studies, for example, for purposes only, and to show people that, in general, the only people who actually succeed are the people who actually spend years mastering their craft, like going to university for a professional trade, you have to put, in the work, the time, the sacrifice, pain the, frustration, and sometimes the loss to be able to achieve any type of results. Therefore, your results will vary and depend on many factors …including but not limited to your background, experience, dedication, and work ethic. We don't know you and, besides, your results in life are up to you. Agreed? We just want to help by giving great content, direction and strategies that move you forward faster. Nothing on this page or any of our websites is a promise or guarantee of future earnings. . Anyway, all of our terms, privacy policies and disclaimers for all of our programs and events can be accessed via the links above. We think these disclaimers are important and we post them because it's the right thing to do all business that entails substantial risk as well as massive and consistent effort and action. If you're not willing to accept that, please DO NOT GET OUR INFORMATION.

If you do not agree with any term or provision of our Terms and Conditions, you should not use our Site, Services, Content or Information. Please be advised that your continued use of the Site, Services, Content, or Information provided shall indicate your consent and agreement to our Terms and Conditions. Platinum Traders Beta Testers Group may publish testimonials or descriptions of past performance but these results are NOT typical, are not indicative of future results or performance, and are not intended to be a representation, warranty or guarantee that similar results will be obtained by you. Peter Parks experience with trading is not typical, nor is the experience of students featured in the testimonials.

They are experienced traders. Becoming an experienced trader takes hard work, dedication and a significant amount of time. Your results may differ materially from those expressed or utilized by Platinum Traders Beta Testers Group due to a number of factors. We do not track the typical results of our current or past students. As a provider of educational courses, we do not have access to the personal trading accounts or brokerage statements of our customers.

Available research data suggests that most day traders are NOT profitable. In a research paper published in 2014 titled “Do Day Traders Rationally Learn About Their Ability?”, professors from the University of California studied 3.7 billion trades from the Taiwan Stock Exchange between 1992-2006 and found that only 9.81% of day trading volume was generated by predictably profitable traders and that these predictably profitable traders constitute less than 3% of all day traders on an average day. In a 2005 article published in the Journal of Applied Finance titled “The Profitability of Active Stock Traders” professors at the University of Oxford and the University College Dublin found that out of 1,146 brokerage accounts day trading the U.S. markets between March 8, 2000 and June 13, 2000, only 50% were profitable with an average net profit of $16,619.

Citations for Disclaimer Barber, Brad & Lee, Yong-Ill & Liu, Yu-Jane & Odean, Terrance. (2014). Do Day Traders Rationally Learn About Their Ability? SSRN Electronic Journal. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2535636 Garvey, Ryan and Murphy, Anthony, The Profitability of Active Stock Traders. Journal of Applied Finance , Vol. 15, No. 2, Fall/Winter 2005. Available at SSRN: https://ssrn.com/abstract=908615 Douglas J. Jordan & J. David Diltz (2003) The Profitability of Day Traders, Financial Analysts Journal, 59:6, 85-94, DOI: https://www.tandfonline.com/doi/abs/10.2469/faj.v59.n6.2578

© Copyrights by Advanced Marketing Wealth Solutions Inc. All Rights Reseved Worldwide