Master Your Accounting & Taxes In Spreadsheets While Saving Time, Stress & Money!

... without needing Quickbooks or an accountant, even if you have no experience, are overwhelmed or are behind on taxes!

CYBER MONDAY SPECIAL

Master Your Accounting & Taxes In Spreadsheets While Saving Time, Stress & Money!

... without needing Quickbooks or an accountant, even if you have no experience, are overwhelmed or are behind on taxes!

CYBER MONDAY SPECIAL

Are You Tired Of...

Not knowing how to do your accounting? Unsure where to start?

This a hugely frustrating area for small business owners and it's really not your fault at all - the industry has done a horrible job of helping smaller businesses get started...

Being confused if you made the right choice for your type of business & saving taxes

You want to do the savvy things that the big companies are doing to save on taxes, and get all the good deals, am I right? You'd probably even like to understand your business options - is that too much to ask? I think not!

Spending hours researching how to handle business, accounting & taxes?

You want clear answers to your questions and I get it! I started my business because I don't think it's right how you have been forced to struggle through these areas of business...

Dreading tax time and the IRS, all year long!

You just want peace of mind to know that you have what you need for the IRS. Trying to sort through receipts, shoe boxes and bank accounts to get your tax bill lower at year end is no way to run your business...

Struggling to figure out where you are making money and where you aren't?

Even when using accounting software, like quickbooks, it can still be hard to know how profitable parts of your business are. This can be the most important part of accounting records and yet bookkeepers don't usually know how to track this information OR they have to use a spreadsheet (even when using Quickbooks!)

Wanting to know that you're paying yourself correctly, and avoid fines & penalties while saving taxes!

Your pay is a hugely important part of your business and you deserve to pay yourself with clarity!

Trying to hire a bookkeeper or use Quickbooks yourself...

These solutions aren't made for small businesses owners and they aren't designed to educate you and answer your questions either...

Unlike accounting software and hiring bookkeepers, this program is specifically designed for small business owners, who do most things in their business themselves. You need to actually understand the accounting, tax & business options, so that you have the information you need to make decisions!

If You'd Like To...

...Know that you saving the MOST taxes possible!

There's so much contradictory and complicated information out there! There always seems to be yet another bit of information makes me question what I need to do...

...Have your business setup right

So that you don't run into those situations that make you question if you are doing things right - or missing out on something! You've got to learn some things that you don't know you need to know to get there...

...No more fear of the IRS

When you not only have your accounting and tax records organized, but you also understand exactly what to do in certain situations and how the IRS works - you have zero fear or stress around the IRS!

...Get past years accounting & taxes caught-up too!

It can weigh on your shoulders and stress you out to be behind, and most accounting firms take your money without telling you that you need to get them all of the information (so they don't help you with what you are really stuck on), but you can end this when you have access to the information you need...

...have your accounting setup RIGHT!

Without your systems setup and learning a basic level of understanding, the accounting will always be a mess and/or a headache - even with the perfect bookkeeper!

...Easily maintaining your accounting records!

You need to have systems setup and learn the accounting basics, with exactly what you need to know to make it all work for you!

...Want to be able to ask questions?

When it comes to accounting and taxes, it's impossible to not have questions and you just want to be able to have someone to ask your questions who will actually explain the answer, so that you can keep moving forward...

...Stop trying to figured it out on your own and have a step-by-step plan to follow?

I believe you deserve exactly this -- plus, a plan based on your exact questions and situation, so that you can get this done without wasting any time!

Imagine all that pressure gone, what would it mean to finally have the:

CLARITY that comes from having your accounting up-to-date (& knowing it's right!),

TIME to focus on using the accounting reports about your business, to grow your business,

And the FREEDOM from the guilt you might feel about not doing your accounting & taxes, or not knowing exactly what and how you should be doing it.

Now you can use all that crystal clear clarity, extra time and fulfilling freedom to focus on what matters in your business, what you do best, and growing your wealth!

Hey there,

I'm Amanda Russell

MBA, MSA, EA, BUSINESS FINANCE COACH

Despite my high-level background at "big 4" public accounting firms, I didn't fall into the spell that the way things are done is working for all businesses and professionals. I saw small business owners struggling to figure these parts of business out themselves.

Small businesses employ nearly 60 million people. I truly believe that the world needs your business and that you deserve to have the financial freedom that comes from having your own business and bringing your dreams to life.

You May Have Seen Me On...

I created the Master Your Accounting & Taxes Course just for small business owners like you, wanting a simple solution...

You deserve a fast accounting & tax solution that makes your life easier, which is why I created this Complete-Accounting Spreadsheet & Tax Template Library (I continue to use these spreadsheets for my business and personal money tracking too!)

...and instead, use a system that you can master!

With The Master Your Accounting & Tax Program, You Can:

Get access to step-by-step instructions and templates that demystify every aspect of accounting and taxes - this is truly the SIMPLEST and most COMPLETE solution!

If you've felt like you just don't have the time to set up your records, it's not your fault! Common solutions can't be done in a reasonable amount of time.

If you are ready to quickly get your accounting & taxes caught-up and setup right, to save taxes, and use the accounting to grow your business....

... then the Master Your Accounting & Taxes program may be the perfect solution for you!

How Does The Master Your Accounting & Taxes Program Work?

In this Special Offer, You'll Receive:

24/7 Instant Access To The Video E-course Content: Follow the 5 Steps To Master Your Accounting & Taxes with step-by-step guidance for setting up your business finances in spreadsheets for easy accounting & taxes (plus the Bonus E-courses)

LIVE Zoom "Office Hours": Wednesday Dec 7, Dec 21, Jan 11, and Jan 25 at 2pm EST

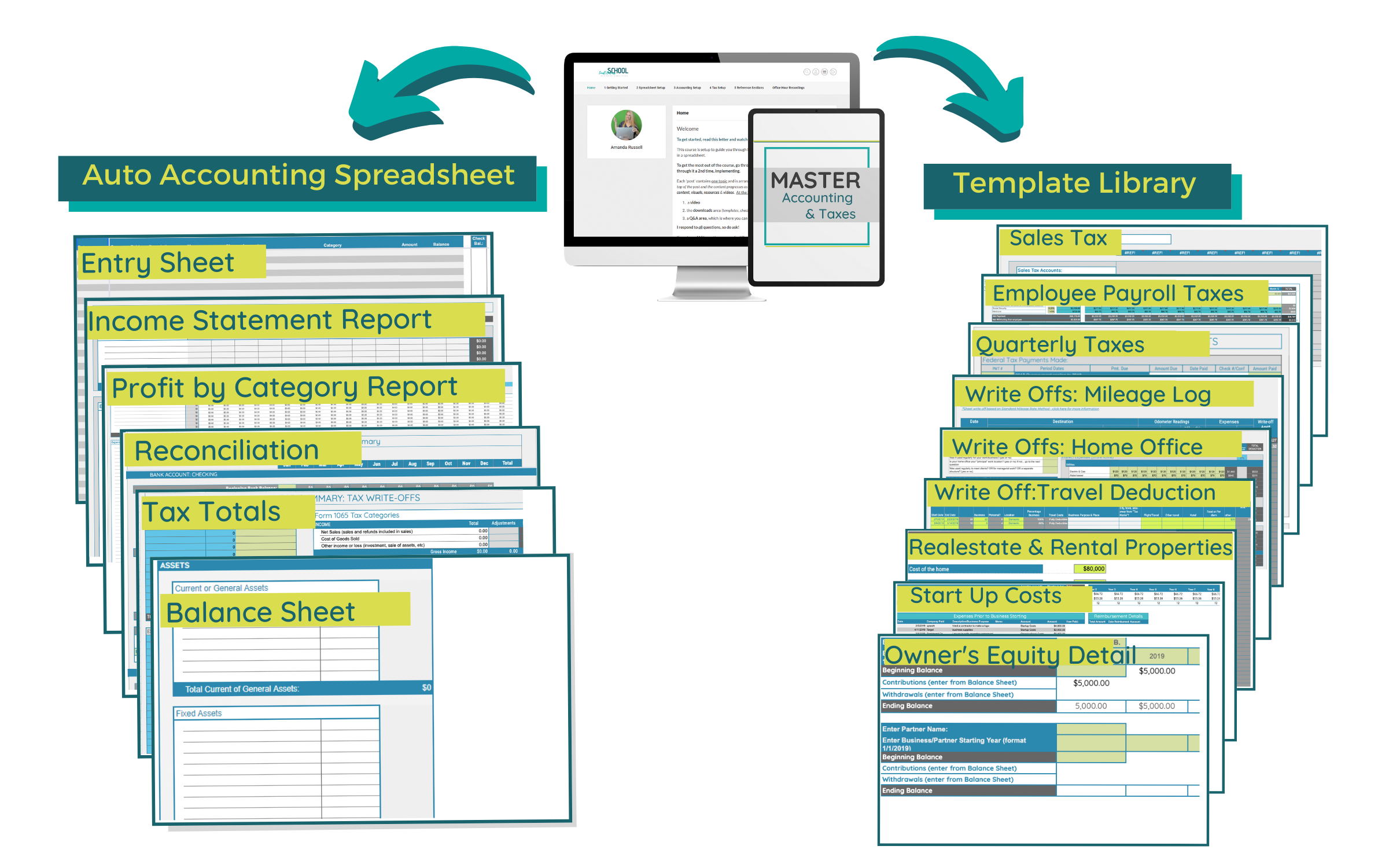

Auto-Accounting Spreadsheets & Tax Template Library: Complete accounting templates for every type of business, with templates to track everything you need for all finance and tax situation!

Checklists & Cheatsheets: Guide you through every concept and step so that you can easily refer back and and review concepts & steps, during the year!

Answers To Your Questions: Throughout the E-courses, you can ask your questions at every training post and we will respond weekly (1 year access)

Plus, Get The Following Bonuses:

This course covers the exact steps to approach starting a business & getting setup proper... From the legal, to the accounting and taxes, to sales and marketing, and beyond!

This course gives you context so that you can save time, money and relationships, while quickly taking advantage of opportunities as they come your way...

Learn everything you need to know about investing in retirement plans as an individual and as a business owner. This 2 hour training guides you through getting started, learning the basics, and what you must keep track of. It includes the templates you need to do so as well. It also includes my recommendations for getting started as quickly and easily as possible!

Behind on your taxes and tired of dreading & procrastinating getting caught up? This course guides you through the exact steps to take to get your past years taxes caught-up, without triggering an IRS audit.

Want to finally setup your LLC? Or maintain the one you have correctly? This course walks you through setting up your LLC, and maintaining it. (or check the one you already have)

Will the s-corporation save me money? How do I pay myself? This course covers exactly how to decide about, setup and maintain the s-corporation. Even if you use a pro, you still need to know if it's being done correctly!

This course teaches the foundation about business that can END the confusion for good... Plus you'll also learn how to setup any type of business too!

Learn how to pay everyone in your business (workers and owners), step-by-step!

Plus, if you're an s-corp, this course guides you through every step of doing your owner payroll, including getting caught-up and saving you $$$!

Basis is your investment in your business, and you MUST know what your basis is to avoid ALL taxes on your distributions!!!

Mandatory for S-corps and multi-owner businesses!

Learn about the world or rentals, flipping real estate, and more.... learn how to use our templates to track it and the basics for the accounting and taxes!

Learn from others who have setup and used the spreadsheet... Participants reported this to be super valuable to really learn the material and get all the questions & concerns in your head - ANSWERED!

What You'll Learn & Accomplish

STEP #1: MAKE DECISIONS

So that you can clearly move forward knowing with clarity, knowing your business is best for your situation and your finances are organized right!

STEP #2: SETUP YOUR SYSTEMS

Learn the best way to get setup to stay organized and save everything you need for your business! Setup systems for your accounting process, documentation system and accounting spreadsheet

STEP #3: RECORD YOUR TRANSACTIONS

Learn how to record all of your transactions and get your accounting records setup right, in the simplest and easiest DIY accounting solution! Learn how to record sales, expenses, your pay, business investments, owner draws, credit cards and loans, and much more!

STEP #4: USE YOUR ACCOUNTING REPORTS

Use your reports to know your money and make business decisions. Our spreadsheets are a complete accounting record, which include the Income Statement & Balance Sheet Reports, plus the ability to track profitability by categories, totals for contractors or companies paid & amounts received from clients, sales tax, and more!

STEP #5: SETUP YOUR TAX SYSTEMS & FILE TAXES

Learn what you need to track for taxes and setup our tax templates for your situations, including Quarterly Estimated Taxes, sales taxes, and filing your taxes at the end of the year.

Total Value...

The Master Your Accounting & Taxes E-course (Value $7,200)

(Valued at the price of quality accounting services, which start at $600/month = $7,200 for just 1 year)

The Complete Accounting Spreadsheet & Tax Template Library (Value $4,800)

(Valued at the price of accounting software, which averages $40/month = $480/year = $4,800 for 10 years - you get to keep our spreadsheet templates forever and they can be used for personal finances too)

Ask Your Questions in every training for one year (Value $2,000+)

The peace of mind that comes from knowing you have everything you need to succeed! (PRICELESS!) Plus, knowing you:

That means the total monetary value of this program is $14,000!

Today (on my website), the Master Your Accounting & Tax Course costs $1,497

But for this PRE-CYBER MONDAY SPECIAL, you get 33% off... PLUS, 10 BONUS COURSES (Valued at $3,000)

(These courses are for sale on my website at $297 per course and you get them all for free)

Your Investment is only:

Do-It-Yourself (DIY) with Q&A = $999

Ready To Master Your Accounting & Taxes, Using the Easiest & Fastest Solution for Small Business Owners?

Do-It-Yourself (DIY) With HELP!

Master Your Accounting & Taxes: DIY E-courses + LIVE Q&A "Office Hours"

E-course 24/7 Video E-course Access

All Bonus E-course Included

Zoom Office Hours Dec 7, Dec 21, Jan 11, Jan 25

Save All Course Content for LIFE (videos, templates, etc.)

Ask Questions On Our Course Platform (1 year access)

$1,497

$999

one payment

Video

E-Courses

Instant access

Step-by-step

Video E-courses

Google Sheets

Templates

Accounting & tax spreadsheet templates

On-going Answers

Office Hours & Post Q&A in courses

Whether you are behind or just starting, this workshop can help you finally get setup right and END the common business accounting & tax struggle, for good!

What People Are Saying...

hgjh

Mark T from Canada

Founder & Owner - Construction Company

You took my hand and walked me down the road. You showed me how easy it is to stay on top of my books and my company. Because of that I now see how I can grow the company to where I would like it to be.

Tom N from PA

Consultant

It was outstanding! The spreadsheet for tracking my business expenses, quarterly taxes, balance sheet, etc. was just what I needed. Having the ability to talk directly with Amanda and get her advice was worth way more than I paid for the class!

Hand holding by Amanda to get the spreadsheet right made all the difference...You can read all the books you want, but being able to ask a question to someone who knows what they are doing was a huge plus."

Frequently Asked Questions

If you've read through this sales page, and you relate to the struggles and desires we've explained, then this course is probably perfect for you.

However, there are some situations the spreadsheet isn't setup for or that you should expect to invest additional time and/or resources. These things aren't usually applicable to small business owners, but apply if you have a more mid-sized business.

The following circumstances:

Also, it's worth pointing out here that sometimes people are looking for something that doesn't exist. We cannot change the NATURE of accounting; it is cumbersome! This course is the simplest solution I've found (which is why I created it!)

While you need to learn how to use spreadsheets, that's a beneficial thing to learn because spreadsheets can be used for many aspects of business. (versus learning an accounting software which can only be used for accounting)

If you still have questions about 'if this course is right for you,' shoot us an email at contact@amandarussell.mba. We would love to help you decide before you register.

Although access is only for one year, you are able to save all of the course content for lifetime use (videos, spreadsheets, templates, checklists & cheatsheets).

The reason access to our e-course platform is limited is because we are continually improving and adding to the course, and we answer questions weekly. You can ask questions at every training post.

When your year access is about to expire, you'll receive emails prompting you to save all of the content and an offer to renew your access for a smaller fee.

Yes, this program still applies to you! You are in the great position of getting setup right as you are starting, instead of having to get caughtup later on.

Our complete accounting templates cover all types of legal and tax business (LLC, sole proprietor, partnership, s-corporation, and c-corporation).

Plus, the template library that covers optional templates, for specific situations like cost basis of real estate, mileage log, home office, calculating gain or loss, tracking basis, etc.

Even when business owners think they have a simple situation, often there are more aspects that come up that require more tracking once we get into their accounting records. This bundle includes all of those courses so that whatever situation arises, you'll have what you need to complete setting up your accounting and taxes correctly!

Throughout all of the E-courses, you can ask questions on every training and get answers weekly throughout the year of your access.

We've chosen not to offer refunds. As business owners, we all have to make a choice - to offer "Money Back Guarantee" or not offer this type of policy. Obviously, there are various considerations based on the type of service and product you offer.

These are the reasons I've chosen not to do a guarantee:

Our spreadsheets only come in Google Sheets!

The issue we had with Excel was that there are many different versions and this created a lot of confusion. Plus, we found a superior solution within Google Sheets.

Google sheets are hosted online on a weblink, so you can access them from any computer and don't need to worry about having files and different versions. Google sheets are also completely free, you just need to setup a google drive account and we provide instructions to do so if you don't have a gmail account already (gmail comes with a google drive account automatically)

Also, google sheets has been a better solution because you can add us to your template (or your accountant or a tax pro or investor or partner or assistant!) and you can comment on any cell in the spreadsheet. This makes it easier to communicate about the numbers (or formulas or issues) directly in the spreadsheet. You also don't have to worry about having different versions, losing work and you can access your google sheets from any web browser!

Yes, this course is for you! The accounting spreadsheet templates apply to your business.

The Bonus E-course: Setup & Maintain Your S-corporation help you decide if the S-corporation is or will save you money and guides you step-by-step through electing S-corporation status and everything you need to do to maintain the s-corporation.

The course can be reasonably done over 6 weeks of 2-3 hours per week, which includes applying the content to your situation.

However, this is completely subjective. Some people might do the course in a week. Some people like to go through the entire course and then do it again and then apply it to their situation. Keep in mind that the content can often be best understood while actually doing the steps, versus just consuming the content. The amount of time you spend will be more for some and less for others; it really depends on your situation.

If you have trouble making time for accounting or procrastinating in these areas, the best thing you can do is commit to 15-20 minutes per day. Go through one training post at a time. You'll find that you get through the content before you know it!

Technically, in accounting lingo, yes this course is all you need for your "accounting records" and "tax records." But, that's accounting language, which you probably do not know - that's why you are here!

Some situations may need my other courses. Many situations will only need the Master Your Accounting & Taxes course. Regardless, with this special offer, you get ALL of our bonus courses, which is great because sometimes you don't know what you don't know and need. Therefore, you will have absolutely everything you need!

To learn more about the course (and bonuses), check out the registration page on my website HERE, but be sure to come back to this tab for this Special Offer!

© Copyrights by Ut Du LLC 2022. All Rights Reserved.